During the last week of the Trump administration, the Federal Government has released their findings on Vietnam’s Section 301 violations. These findings may have a significant impact on trade, as Vietnam is the US’s 10th largest trading partner — with a whopping $72 billion dollars of Vietnamese imported goods entering into the country.

Before we discuss the actions that Vietnam has taken to violate Section 301, we will cover what this section outlines.

What is Section 301?

Under the Trade Act of 1974, this section allows for a United States Trade Representative (or USTR — in the case of the Vietnam investigation, the USTR is Robert Lighthizer) to impose import restrictions or suspend trade agreements if the USTR deems that a US trading partner is violating their agreement. You may review the Trade Act here.

The document link above also outlines the recourse for investigation, why and how a country would be non-compliant to Section 301, and the various consultations that must be initiated during an investigation. There are also recent trade investigations listed on Page 2, that gives readers an idea of what kind of issues and actions taken might occur.

Quick Overview on the Vietnamese Investigation

The Federal Register released a Notice of Determination Pursuant to Section 301: Vietnam’s Acts, Policies, and Practices Related to Currency Valuation that outlines the various violations. It was concluded that Vietnam’s trade actions and business operations were “unreasonable, burdensome, or restrictive” to US commerce. What actions and operations? Pulling from the supplementary report:

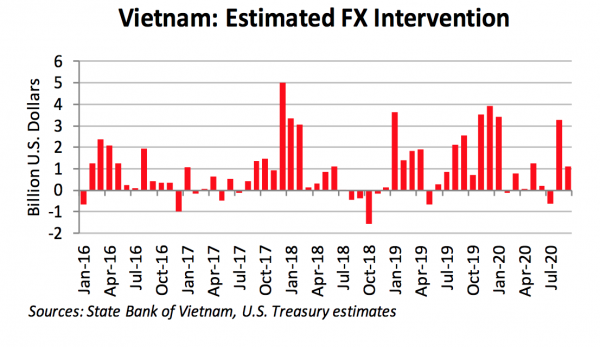

“[…] Vietnam manages its exchange rate based on its interest in achieving certain economic goals; that the acts, policies, and practices it has chosen with respect to the exchange rate have contributed to undervaluation of the exchange rate; that Vietnam uses FX market interventions as a key tool to manage the exchange rate in a manner that has contributed to persistent undervaluation; and that this undervalued exchange rate is accompanied by substantial current account and trade imbalances (including with the United States).

Vietnam’s acts, policies, and practices that contribute to currency undervaluation through excessive foreign exchange market interventions and other related actions burden or restrict U.S. commerce within the meaning of section 301 of the Trade Act.”

The report provides 3 main outcomes of Vietnam’s practices as:

1 – Currency undervaluation lowers the price of exports from Vietnam into the US, resulting in undervalued Vietnamese imports.

2 – This currency undervaluation raises the price of US exports to Vietnam, making it difficult for US-importers to compete.

3 – “Excessive” foreign exchange market intervention while Vietnam has an account surplus undermines the US’s ability to export.

However, at this time, it is noted that no specific actions or penalties have been laid out, but they reserve the right to continue evaluating possible options for justice.

—

These types of investigations are certainly important for supply chain and trade professionals to take note of. Regardless of the size of your importing practice, these reports may have an impact on your business operations. We often note how important it is to stay privy to the economic and regulatory changes, because these things do have an impact on your bottom line.

Customs consultants and customs brokers are required to stay informed on these changes and help businesses navigate them. To team up with a customs professional, or get more information on what a partnership could look like, click here.