It is of utmost importance that importers — or any businesses within the supply chain, for that matter — are aware of the various penalties implemented by CBP for importing into the US. Customs experts consistently warn of the costly, and possibly disastrous, results of non-compliance with CBP regulations. In essence: non compliance is expensive.

As such, we’ll be breaking down a variety of penalties that importers must look out for, to adjust their business dealings accordingly. Kevin Doucette, director of North American trade policy and compliance for logistics company, CH Robinson, warns:

“Use common sense. If something feels off about a transaction, stop and investigate. The potential consequences of proceeding in error can be extremely high.”

What are importing penalties, anyway?

US Customs and Border Protection (CBP) defines their penalty program as such: they target and penalize lawbreakers through monetary penalties and legal action. Unfair, unsafe, or illicit trade practice is not tolerated within US supply chains.

In brief, the penalty program was built to deter non-compliant imports — consistently applied across 326 ports of entry and 42 field offices.

How are import penalties applied?

The provisions for these penalties start with one baseline question. Did the non-compliant import cause CBP to suffer a loss of revenue or not? Then, the non-compliant import will be classified in 3 various ways, calculated on the degree of loss of revenue that occurred as a result:

- Negligent

- Grossly negligent

- Fraud violation

Kevin Doucette explains this further:

“An organization misclassified an item. It should have used the classification with a 6% duty rate. However, due to the misclassification, it has been using one with a 0% duty rate. […] Customs could charge the company with gross negligence; the penalty being 2.5 to 4 times the 6% duty rate. Or if it’s a non-revenue violation, the organization could be charged 25-40% the value of goods.”

CBP has made guidelines available to the trade community, in order to make it more simple to navigate compliance and avoid penalties. We recommend that readers take the time to go through it. Here is the link: What Every Member of the Trade Community Should Know About: Customs Administrative Enforcement Process: Fines, Penalties, Forfeitures, and Liquidated Damages

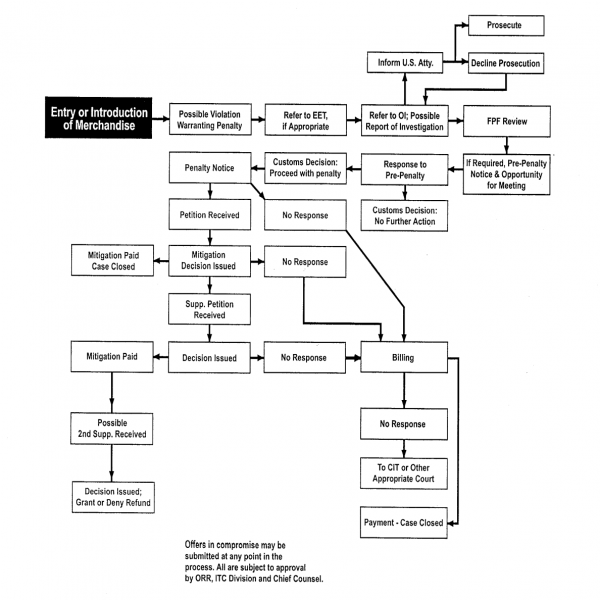

In fact, CBP even provides a flowchart that transparently demonstrates the penalty application process. The violator in question can be any of the involved parties: the importer of record, employees, consignees, etc. Further to this, it must also be noted that there is personal liability for certain types of penalties.

Pre-penalty notices

Prior to CBP issuing penalties, they will first issue a pre-penalty notice to the party, company, or individual with a deadline (most commonly 30 days) to respond with justifications as to why they should not receive the penalty. In some cases, CBP can decide against the penalty, but this is considered to be a rather rare scenario.

Further to this, even if the company receives the pre-penalty notice, it is possible that CBP penalizes individuals without issuing a separate pre-penalty notice.

—

There are certainly scenarios in which trade professionals, like importers, have kept themselves relatively updated on the regulatory framework and still have been in non-compliance. It is absolutely a best practice to continually review the trade processes in place regularly.

Most importers rely on their various partners within the trade community to remain compliant. But is it also essential that importers are paired up with expert customs consultants and customs brokers to work with CBP and clear the border quickly and efficiently. You can get a conversation with an expert started right here.