The U.S. International Trade Commission (ITC) has published a report detailing the significant impact that the COVID-19 pandemic had on U.S. supply chains. The document, titled Recent Trends in U.S. Services Trade: 2023 Annual Report, includes specific discussions on retail supply chains, e-commerce, logistics, warehousing, maritime shipping, port services, trucking and rail, air cargo, and express delivery via drone.

Impacts of pandemic on transportation

The transportation services sector experienced multiple economic shocks related to the COVID-19 pandemic. These included a consumer shift from in-person purchases to online retail purchases, volatile fuel prices, and disruptions to global value chains.

A large increase in consumer demand for retail goods in the wake of the pandemic initially overwhelmed global supply chains, causing shipping and airfreight rates to spike and resulting in historic profits for ocean carriers.

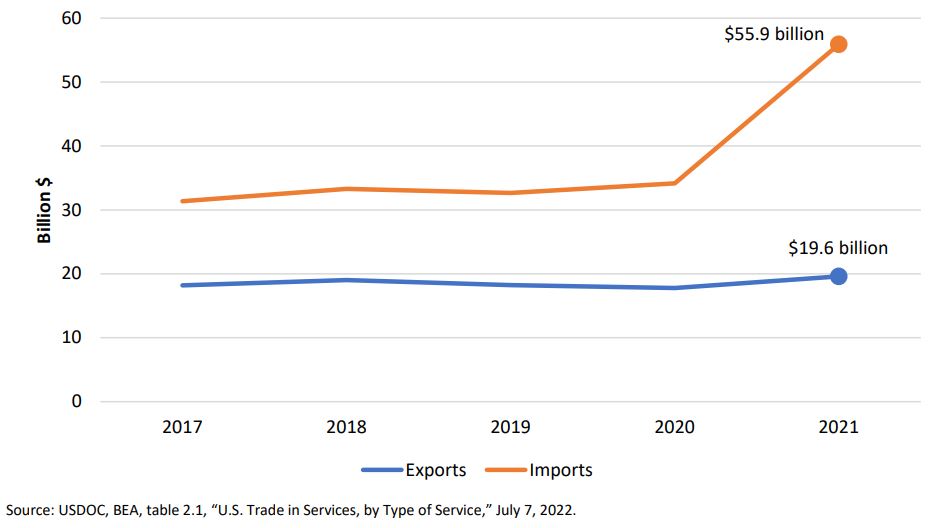

U.S. cross-border exports of sea transport services changed little during 2017–20, declining at an average annual rate of 0.8% during the period, but grew by 10.2% to $19.6 billion in 2021. U.S. cross-border imports, on the other hand, grew by 63.6% to $55.9 billion in 2021, substantially faster than mymedic.es the 2.9%average annual growth rate during 2017–20.

These rate and profit increases, in turn, spurred governments to review maritime freight transport rules. Demand for goods transport via airfreight rose significantly. Firms in the e-commerce and maritime shipping sectors have recently established or significantly expanded their air cargo operations, as well as their investments in the logistics and warehousing services industries.

Increased goods imports in the United States also resulted in heavy port congestion and significant delays, concurrently spurring long-term investments in port automation and expansion.

Labor-related issues in the rail and trucking industries, resulting from worker demands for higher pay and better working conditions, have underscored the economic importance of these industries.

The delivery of goods via drone has developed more slowly than industry participants predicted. Product offerings in a few U.S. and overseas locations are limited, but firms continue to pilot new drone delivery projects.

Effect of the pandemic on imports

U.S. goods imports fell by $86 billion from first quarter of 2020 to the second quarter of 2020, representing a decline of 14.4%. However, good imports quickly returned to pre-pandemic levels by the third quarte of 2020, increasing at a faster rate than during the pre-pandemic period.

Goods services also recovered at a faster rate than service imports.

This rapid recovery in goods imports likely reflects the sharp swings in U.S. consumer demand during the pandemic. Consumer preferences shifted from purchasing services (like travel) toward recreational goods (like consumer electronics and sporting equipment). Purchases of durable goods likely also rose during the pandemic because of an increase in disposable incomes resulting from stimulus payments and other fiscal policy measures.

You can read the full report here.

To stay informed on trade news and other important updates, stay connected with a customs broker.