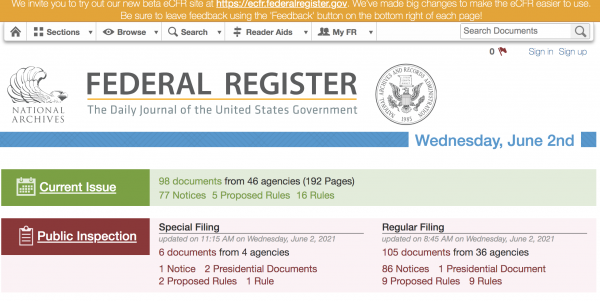

Last month, US Customs and Border Protection (CBP) made a Federal Register Notice public entitled: “Distribution of Continued Dumping and Subsidy Offset to Affected Domestic Producers”. The Federal Register has been an incredibly vital line of communication between CBP and the global trade community, publishing notices almost weekly since 2003. Part of being an informed importer means that you stay aware of the various topics of discussion and changes to regulations by regularly visiting the register. You may access it here.

The Federal Register is the daily journal for the United States Government and a critical tool in learning about varied federal agencies, including CBP. The Office of the Federal Register (OFR), the National Archives and Records Administration (NARA), along with the US Government Publishing Office (GPO), have teamed up to manage and administer FederalRegister.gov. The website was created in order for citizens and communities to understand the regulatory process and provide transparency into the decision-making process.

What is CDSOA?

This notice concerns the Continued Dumping and Subsidy Offset Act of 2000 (CDSOA), which was enacted as a part of the Agriculture, Rural Development, and the Food & Drug Administration, and Related Agencies Appropriations Act (Sections 1001-1003). CDSOA’s purpose was the add a section under the Tariff Act of 1930 to:

“provide that assessed duties received pursuant to a countervailing duty order, an antidumping duty order, or a finding under the Antidumping Act of 1921 will be distributed to affected domestic producers for certain qualifying expenditures that these producers incur after the issuance of such an order or finding.”

What is an Affected Domestic Producer?

“The term “affected domestic producer” means any manufacturer, producer, farmer, rancher or worker representative (including associations of such persons) who:

(A) Was a petitioner or interested party in support of a petition with respect to which an antidumping duty order, a finding under the Antidumping Act of 1921, or a countervailing duty order has been entered;

(B) Remains in operation continuing to produce the product covered by the countervailing duty order, the antidumping duty order, or the finding under the Antidumping Act of 1921; and

(C) Has not been acquired by another company or business that is related to a company that opposed the antidumping or countervailing duty investigation that led to the order or finding (e.g., opposed the petition or otherwise presented evidence in opposition to the petition). The distribution that these parties may receive is known as the continued dumping and subsidy offset.”

What does Federal Notice 2021-10396, “Distribution of Continued Dumping and Subsidy Offset to Affected Domestic Producers”, mean for the trade community?

All duties collected on an entry filed before October 2007 must be distributed as if CDSOA had not been repealed. Pursuant to CDSOA, this notice of intent to distribute assessed antidumping or countervailing duties in 2021 in connection with various orders and findings. This document provides instructions for Affected Domestic Producers (or anyone that alleges eligibility) to receive distribution.

Certifications for a continued dumping and subsidy offset must be received by July 27, 2021.

—

If you have any questions about this notice, or any other regulatory requirements. Contact a broker today!